Tokenomics

Acurast is the decentralized compute network designed to power the emerging decentralized compute economy by aligning developers, compute providers, and end-users around shared incentives.

At the heart of Acurast is the ACU token and economic model, fueling a secure, scalable, and decentralized compute ecosystem while incentivizing active collaboration and sustainable growth.

Also, with tokenomics, the focus is on a sustainable community-first approach.

Key Highlights

- Initial Supply: 1,000,000,000 ACU

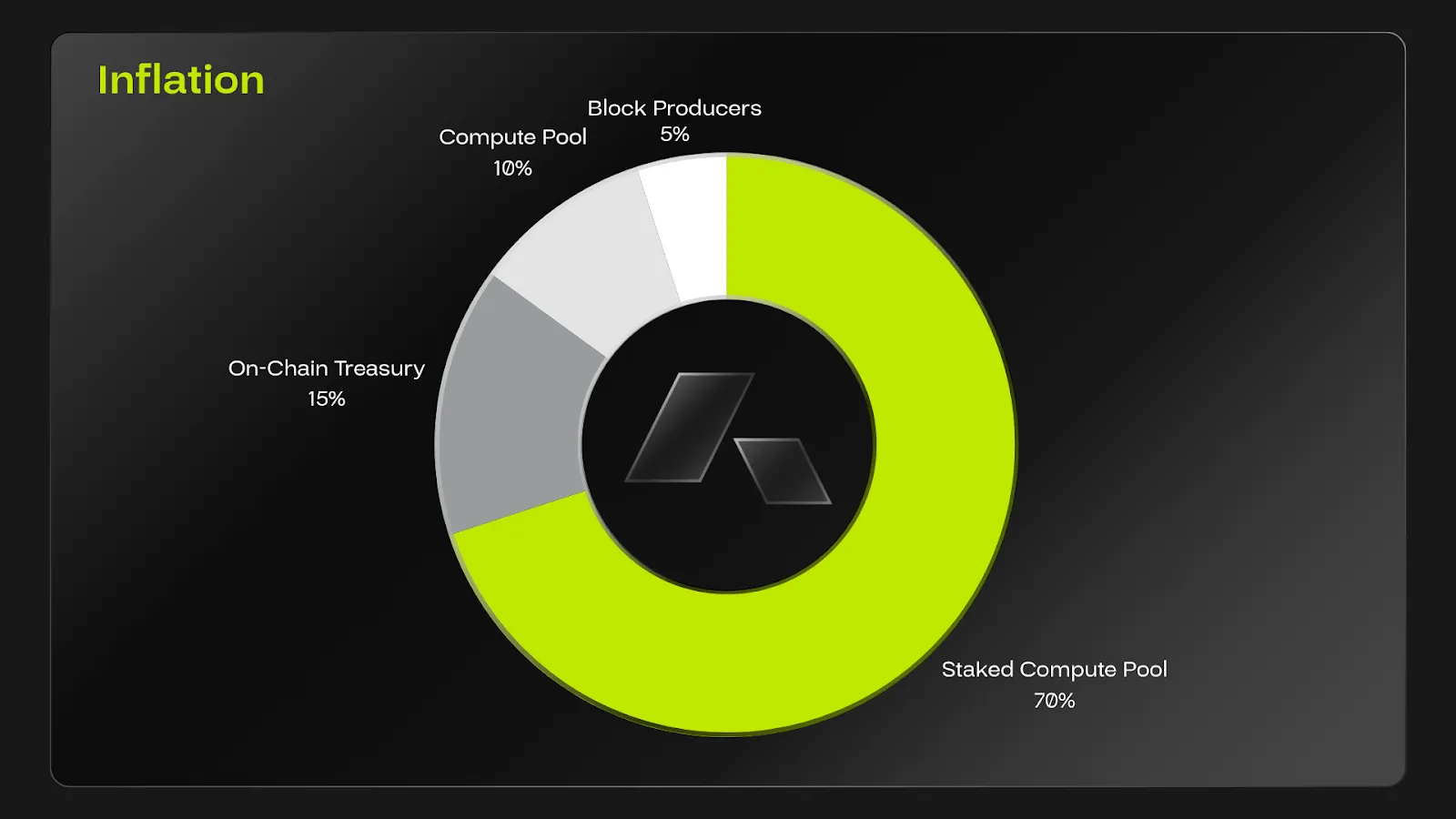

- Fixed inflation: 5% fixed annual inflation distributed to Staked Compute Pool (70%), Compute Pool (10%), On-chain Treasury (15%), Collators (5%)

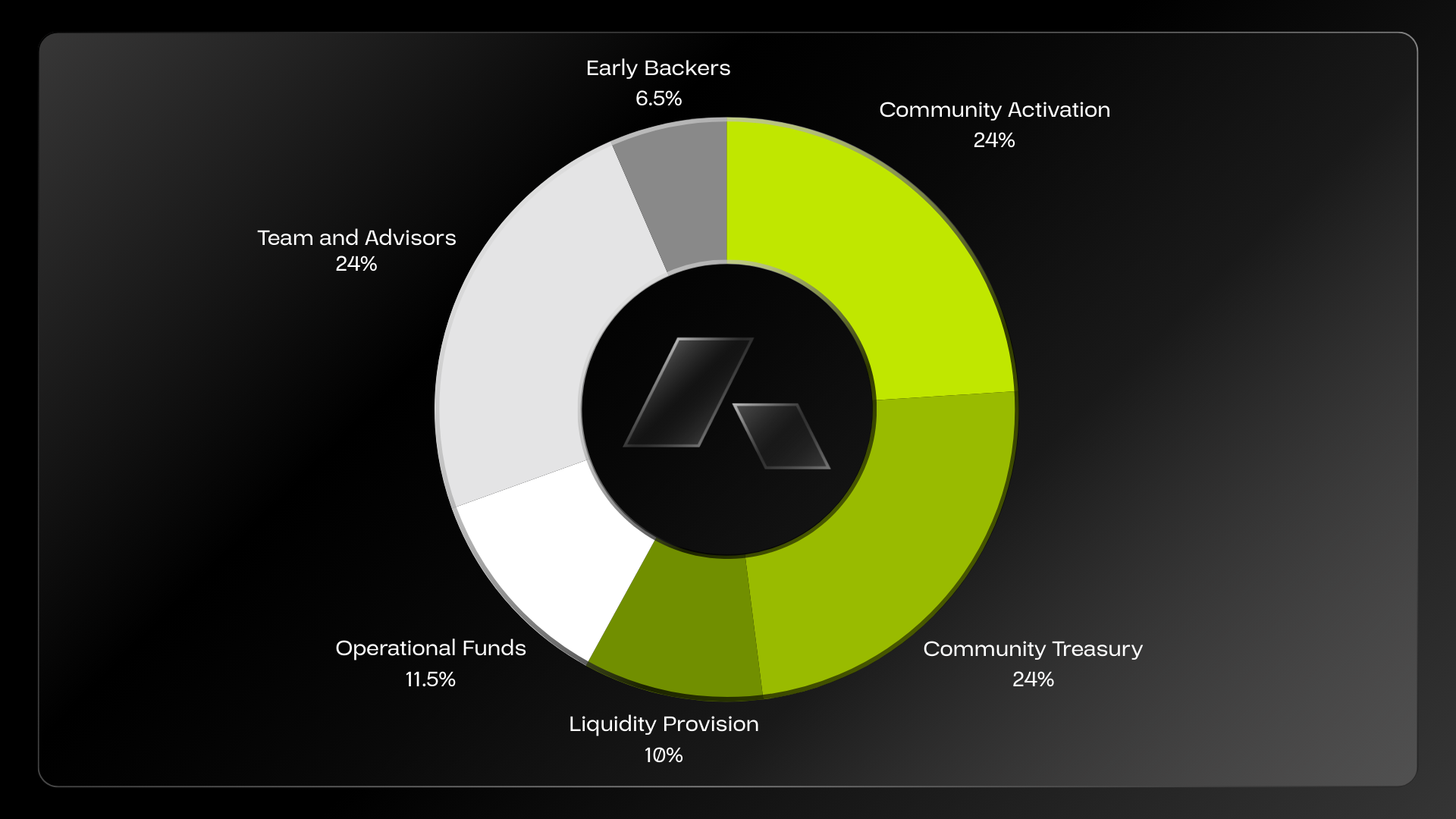

- Only 6.5% allocated to early backers — while important for funding and supporting development all the way to mainnet, this allocation was kept very low in order to facilitate a fair launch of the token.

- Nearly 70% of tokens are allocated to the community or community-supporting purposes (Community Treasury, Community Activation, Operational Funds, Liquidity Provision).

- Team and Advisors have a 6 month lock-up and 36 months linear vesting, aligning them with the long-term mission of the project.

By capping Early Backers at just 6.5% and allocating the majority of tokens to the community and community-supporting initiatives, the token distribution puts the ecosystem interests first, acknowledges early contributions to the broader crypto ecosystem, and fosters the creation of services and products on top of Acurast — ultimately supporting the project's roadmap and long-term objectives. Moving the needle again to decentralization, because decentralized compute is not for the few but for the many.

Token Utility

The ACU token is what makes the entire decentralization of the protocol possible. Decentralization is one of Acurast's core values and impacts every protocol-related decision. ACU enables users to participate and interact with the protocol with these key functions:

- Network Fees As a very active orchestration layer (over 395M transactions on testnet) the Acurast network requires transaction fees to avoid spamming and to keep a high quality of service to this crucial component.

- Incentivization of compute provision: Similar to how Bitcoin rewards miners for creating blocks, Acurast is incentivizing compute providers through fixed inflation.

- Staking: The novel concept of Staked Compute allows Acurast to economically secure reliable, verifiable, and widely accessible compute resources through staking collateral. This enables participants, including those without hardware, to earn rewards, delegate stakes, and leverage restacking for enhanced capital efficiency and network governance.

- Governance: With an on-chain treasury of over 24% allocation, which replenishes itself from part of the inflation. With token holders making the protocol and future development-related decisions.

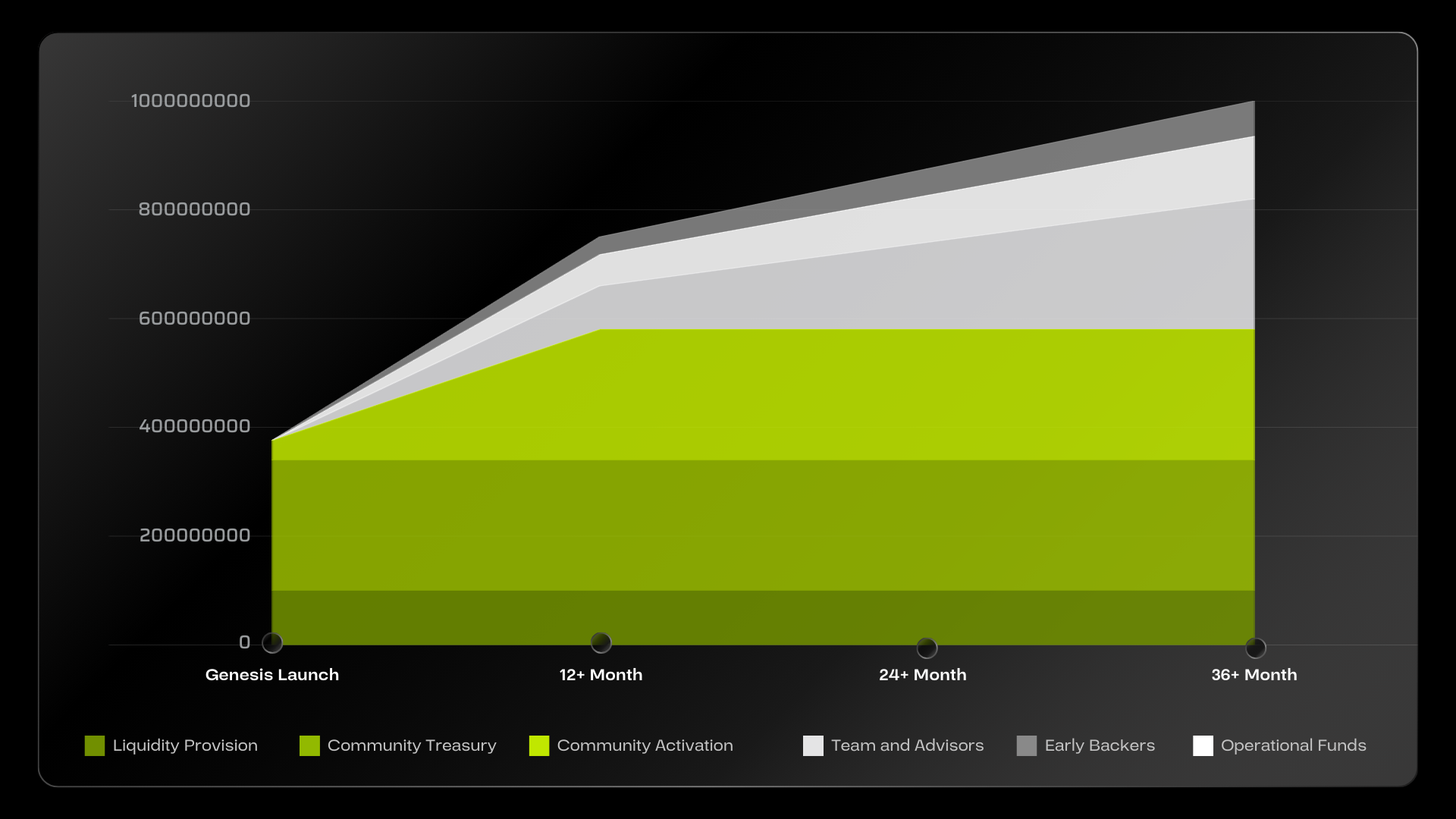

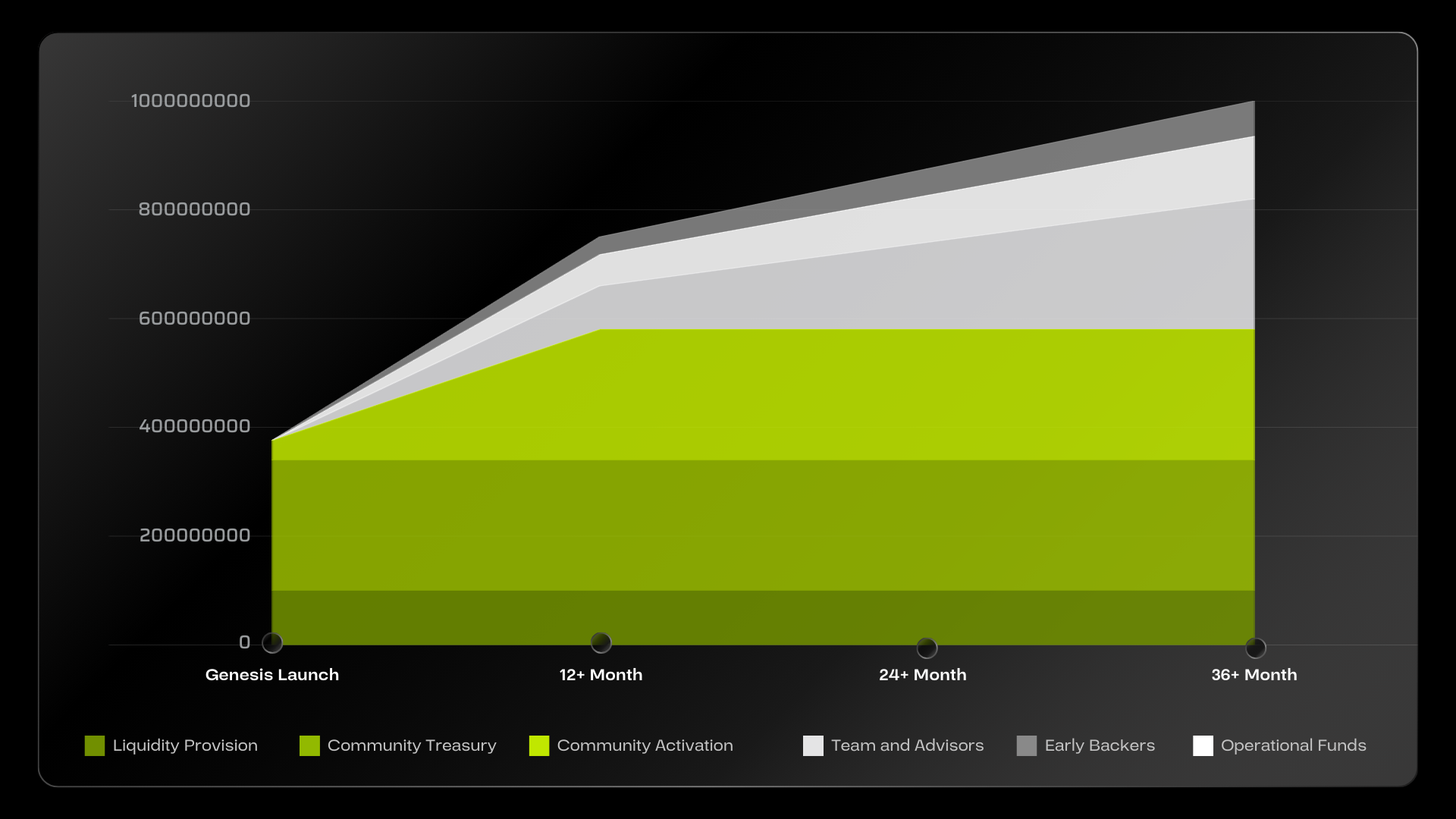

Genesis Token Allocation

Allocation Categories

- Community Activation: Tokens from the participation of the CoinList Token Launch, canary token conversions, airdrops and additional broader activation of the community on TGE.

- Community Treasury: With decentralization in mind from the first day, a large part of the tokens are allocated towards the community treasury, allowing ACU holders to determine through on-chain governance the future development of the protocol and support significant contributions via governance proposals.

- Operational Funds: Strategic funds with the mandate to foster protocol acceleration and growth, governed by the Acurast Association council.

- Liquidity Provision: This allocation is used exclusively to ensure enough liquidity of the Acurast Token on centralized and decentralized exchanges.

- Early Backers: A small, diverse group providing initial funding to ensure the protocol reaches mainnet maturity without heavy institutional influence.

- Team and Advisors: Tokens for the core contributors of the protocol, encompassing employees, advisors, founders and future key team members, with a 6 months lock-up and 36 month vesting; this allocation is structured to align for long-term incentives.

Token Allocations

| Category | Supply | Token Amount (ACU) | Available at TGE | Vesting Cliff (months) | Linear Vesting (months) |

|---|---|---|---|---|---|

| Community Activation | 5% | 50,000,000 | 0% | 0 | 24 |

| Early Compute Providers(cACU to ACU Conversion) (Community Activation) | 6.5% | 65,000,000 | 0% | 3 – 44 (user selectable one time; exit possible any time after 3 months) | 0 |

| Cloud Rebellion Airdrop (Community Activation) | 1% | 10,000,000 | 0% | 0 | 24 |

| Listing Incentives (Community Activation) | 5% | 50,000,000 | 100% | 0 | 0 |

| CoinList Token Launch (Community Activation) | 6.50% | 65,000,000 | 100% | 0 | 0 |

| Operational Funds | 11.50% | 115,000,000 | 0% | 3 | 24 |

| Community Treasury | 24.00% | 240,000,000 | 0% | 3 | 24 |

| Team and Advisors | 24.00% | 240,000,000 | 0% | 6 | 36 |

| Liquidity Provision * | 10% | 100,000,000 | 100% | 0 | 0 |

| Early Backers | 6.50% | 65,000,000 | 0% | 0 | 24 |

* No lockups but only 30% allocated at TGE. These tokens are exclusively used to foster liquidity long-term.

Token Utility

Network Fees: The Acurast network, a Proof of Stake blockchain, acts as an orchestrator for the decentralized compute economy. To interact with the Acurast network, ACU is required for gas fees (i.e., transaction fees).

Staking: Processors and delegators stake ACU to participate in the Staked Compute Pool, earning rewards from epoch inflation for providing and securing compute capacity. Every ACU holder can participate through Delegation without running their own Processor.

Compute Costs: When developers schedule deployments, compute costs are paid as gas fees.

Governance: Holders of ACU can engage in protocol governance by voting on a variety of proposals brought forward by the community, guiding the development of the protocol and its components, and ensuring true decentralization and future-proof evolution by design.

Inflation

Inflation is what makes the Acurast process sustainable by rewarding active participation in the protocol and creating incentives to be run as a decentralized protocol indefinitely. The protocol sets a fixed inflation of 5% annually, depending on various on-chain metrics, and can be further adapted through governance votes.

- 70% → Staked Compute Pool (The rewards for Staking). More on Staked Compute ↗

- 15% → Treasury

- 10% → Benchmark rewards (Base rewards processors, shared in relation to the benchmarks, independent from Staking). More on Benchmarks ↗

- 5% → Acurast blockchain block producers (Collators aka Validators)